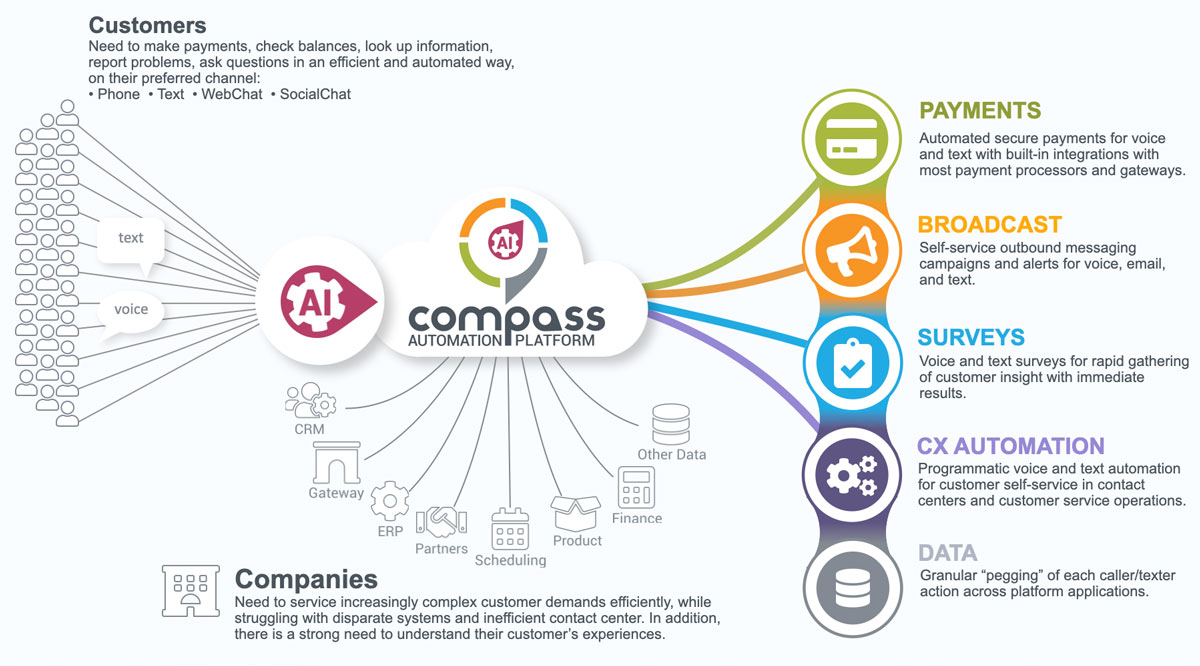

Payments By Phone On The Compass Automation Platform

Think of our Managed CPaaS (Communications Platform as a Service), the Compass Automation Platform, as an engagement conduit between your customers and your data for self-service automation by phone or text. Since it’s a managed platform, you won’t need to devote IT resources to integrate a CPaaS into your customer service stack. We create the voice and text applications your customers need while managing the hosting, security, and telephony networks your technology team needs.

Automated payments by phone is a core capability of the Compass Automation Platform and one of its most popular use-cases. In fact, in January of 2022, the platform processed more than 600,000 transactions for our customers and partners (totaling nearly $90 Million). That’s an average of a transaction every 4.5 seconds! To help you understand how we help you deliver frictionless payments by phone to your customers, we’ve put together a step-by-step explanation below.

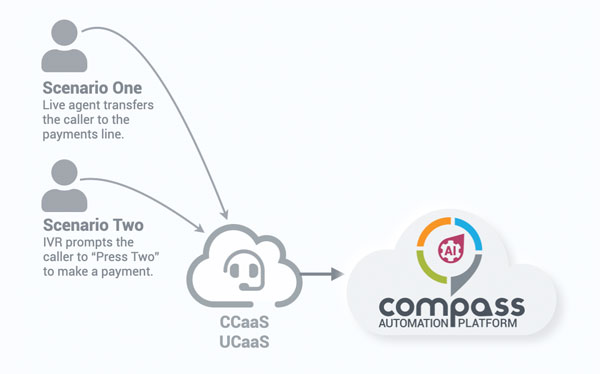

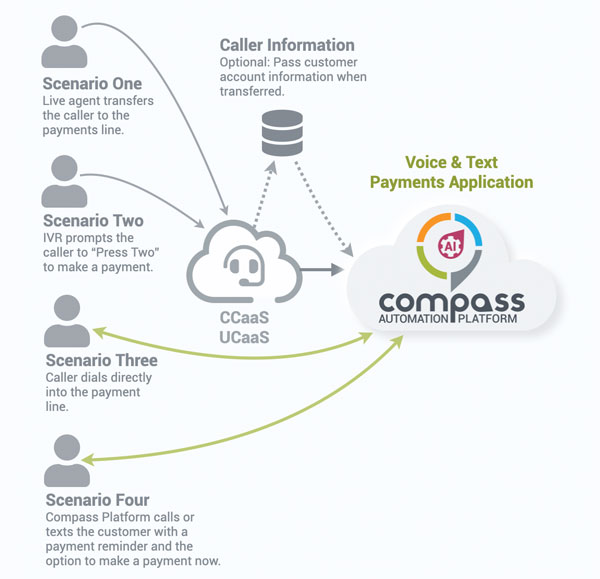

Contact Center Transfer

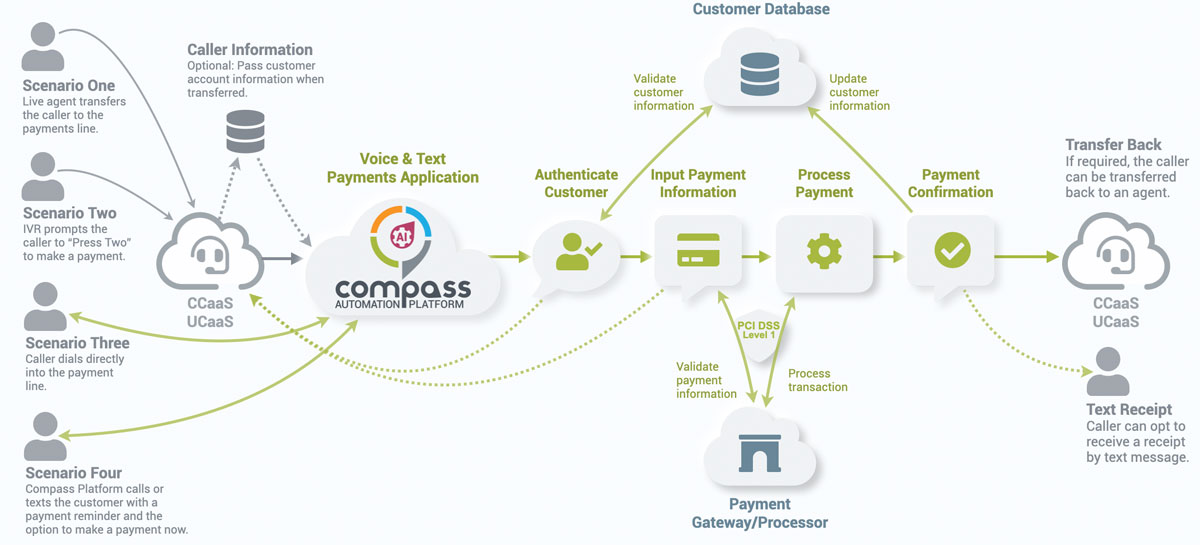

If you’re using a contact center in your business, your customers can access the automated payments line by one of two methods.

Live agent transfer: your representative will be able to transfer customers at any time. This option is beneficial when customers may need a question answered before making a payment.

IVR prompt: with this option, you can set up your IVR or auto-attendant to prompt customers to go directly to the payments line. For example, “Press two to make a secure payment by phone.”

Direct Dial & Payment Reminders

Ideally, you want your customers calling into your payments line whenever they need to pay by phone. You can drive awareness and adoption by publishing the phone number for your payments line on invoices, website, social media, and anywhere else your customers frequent. Our goal for scenario three here is customers proactively calling your payments line to make a payment.

Many companies have reduced late payments by sending out payment reminders a few days before the due date. In this fourth scenario, your CRM would connect to the Compass Automation Platform’s API and let us know who to remind. Reminders can be in the form of a voice call, SMS message, or even an email.

Know Our Caller

Knowing our caller presents an ideal customer experience. When your contact center can pass along critical metadata such as the Caller ID, name, account number, and more, we can move your customer through the call flow more quickly.

An additional method of knowing our caller is to integrate with your CRM at this stage. If you’re capturing customer phone numbers, we can look up customer information based on Caller ID.

Instead of the IVR prompt saying, “Please enter your account number,” we’re able to welcome the customer with, “Hello James, are you ready to make your payment of $321.72 now?”

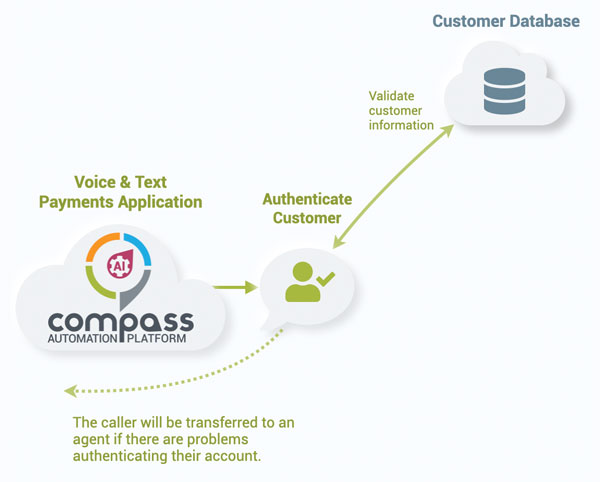

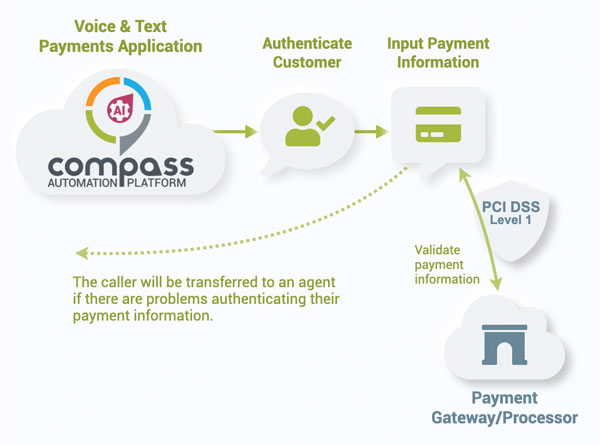

Authenticate Our Customer

If you haven’t helped us know our caller, that’s okay; we can quickly authenticate your customer using one of two methods.

SFTP & flat-file: in many cases, especially with billers on legacy systems, this is the most common authentication method. We provide you with a secure SFTP directory to upload a CSV file of customer account information. The data format is simple, and just about any legacy CRM or account system can easily generate these.

API: More modern CRM/ERP systems can easily integrate with our API for real-time access to your customer information. When available, this is the ideal method for customer authentication.

Validate Payment Information

Now that we know your customer and their account information, it’s time to ask for their payment information. We accept all major credit cards, debit cards, and payments from checking and savings accounts through ACH (actual methods may depend on your gateway/processor). Your customer enters their payment information by voice or keypad.

Next, we initiate a secure connection to your payment processor or gateway and validate their payment information. If we run into a problem, we’ll let your customer try again. Typically, after three failed attempts, we transfer your customer to a customer service agent, but this is up to you.

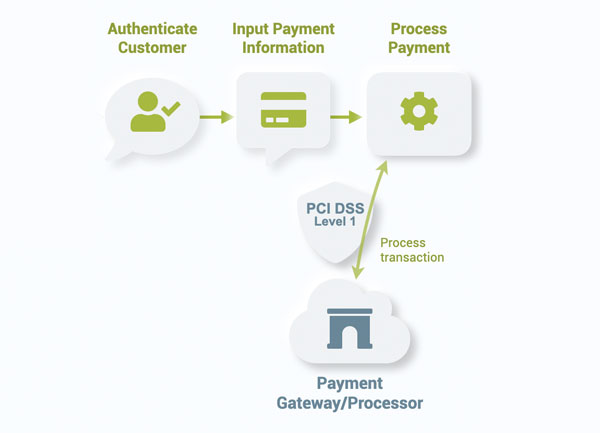

Process Payment

Now it’s time to process that payment with your gateway or payment processor. We accept the major credit cards, debit cards, or checking/savings ACH transactions supported by your gateway.

At this stage, we also support split fees if necessary. For example, if a $200 payment requires a $2 convenience fee, we process the $202 payment by the caller, then deposit the $2 fee in a separate account.

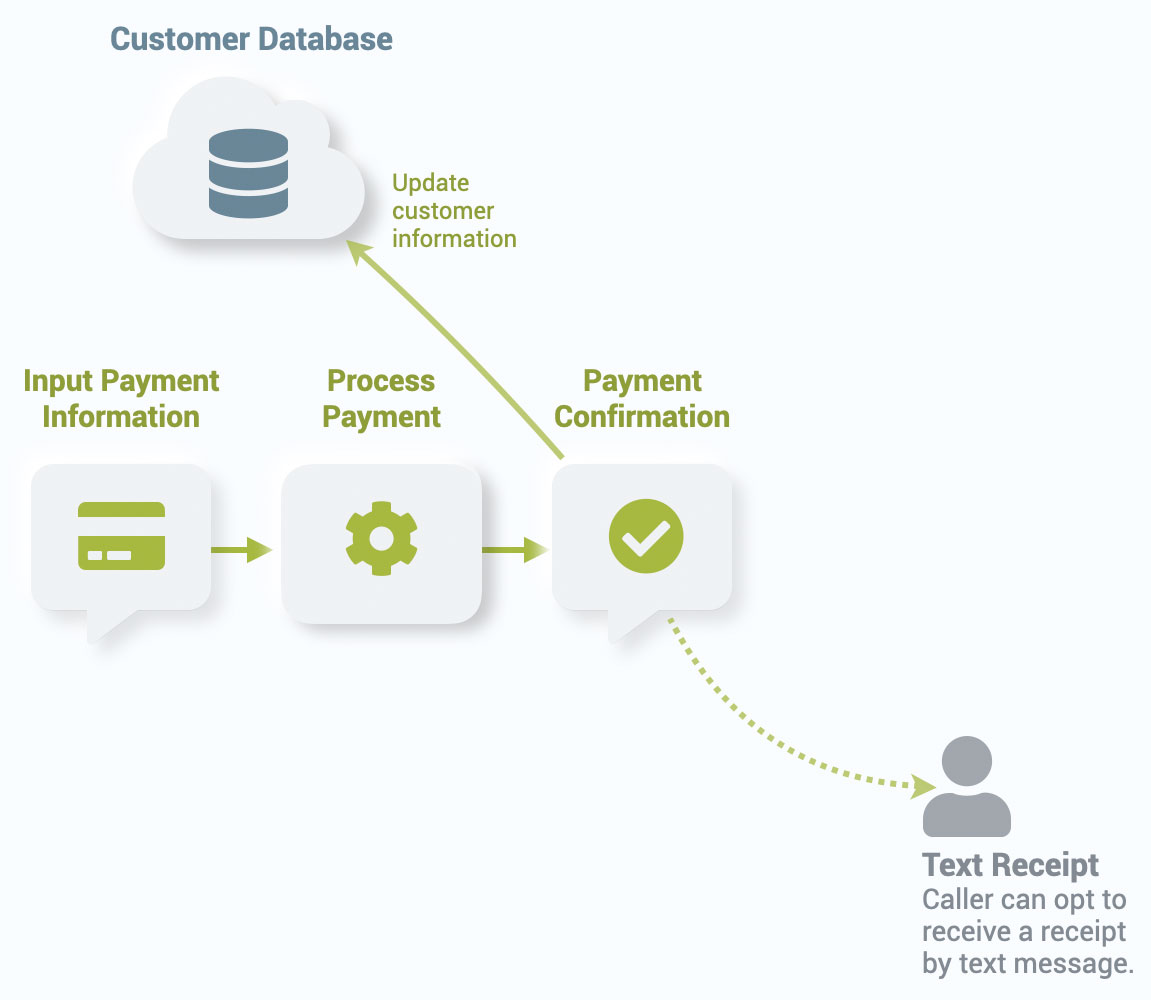

Conclude Transaction

Upon receipt of a completed payment and confirmation number from your gateway or payment processor, we update your customer records. Depending on the method you’re using, we either connect to your API endpoint or update the CSV flat file for your reconciliation.

At this stage, the caller can either receive the confirmation number by voice over the phone (and ask for a repeat if necessary) or have a text receipt sent to their mobile phone.

Optional Transfer

If your caller has additional questions or business, they can request a transfer to your contact center. If not, all they need to do is simply hang up.

Full Payment By Phone Call Flow Diagram

And here is the complete payment by phone call flow, from start to finish.

If you’d like to learn more about automated payments on the Compass Automation Platform, such as the flow for a payment by text, our integrated payment processors and gateways, amazing customer stories, and more, download our eBook. Or, contact us, and one of our experts will help you understand how your customers will love automated payments by phone and text, and you’ll love the benefits to your business.